Thriving Through Holistic Health and Financial Advising

In today's fast-paced world, achieving wellness involves more than just physical health. A comprehensive approach that integrates Health & Medical insights and Financial Advising strategies can lead to a more balanced and fulfilling life. At greenweblife.com, we strive to empower individuals with the knowledge necessary to not only care for their bodies but also manage their finances wisely. This article explores these crucial categories, emphasizing their interconnectedness and offering actionable advice for readers.

The Importance of Health & Medical Awareness

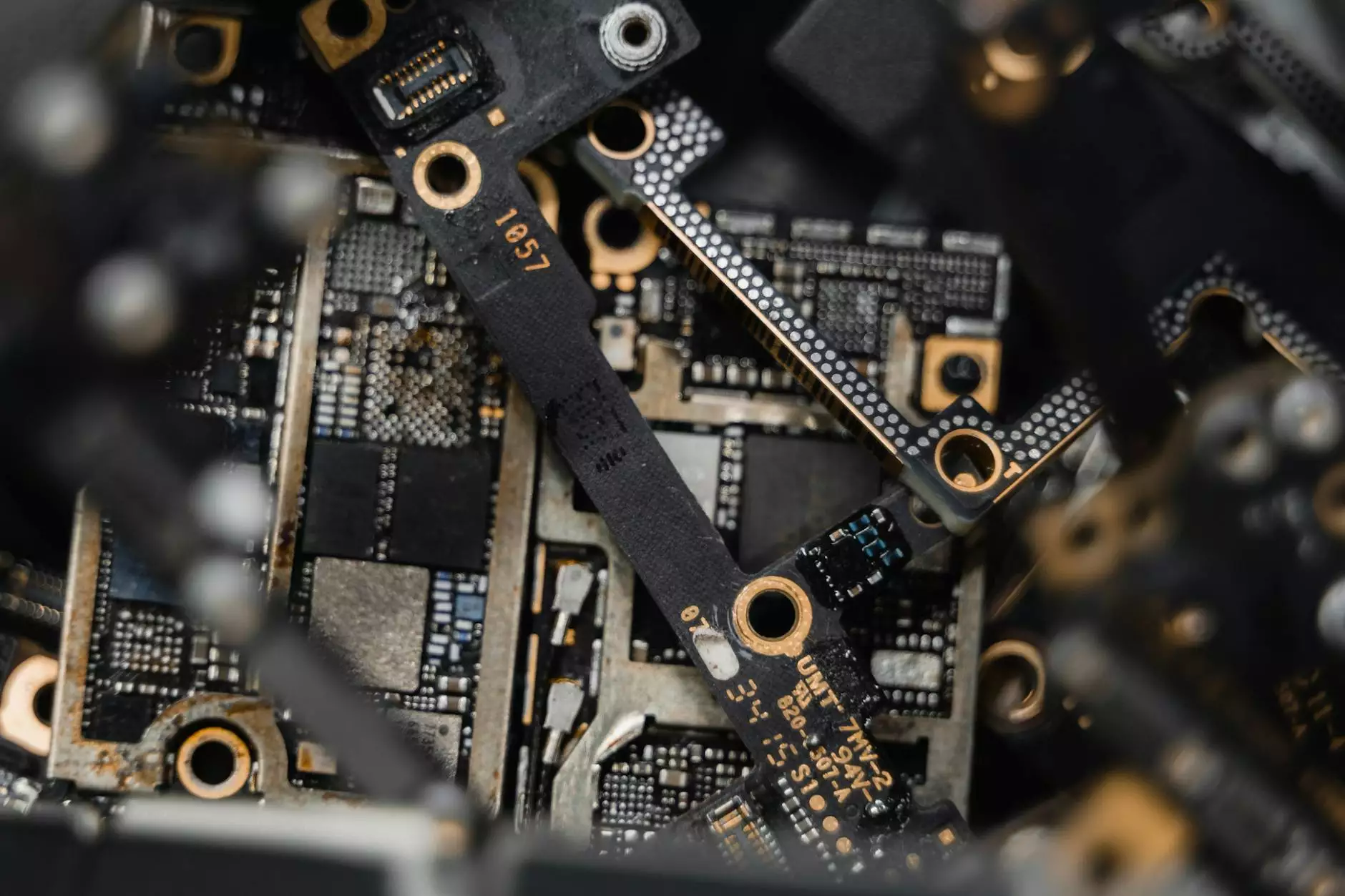

The modern landscape of health is brought to light by advances in medical technology and wellness education. Understanding and prioritizing one’s health is paramount. Engaging in regular health check-ups and being knowledgeable about one's medical history can prevent many chronic illnesses.

Key Components of Health Awareness

- Regular Check-Ups: Scheduled visits to healthcare providers help in early detection of potential health issues.

- Nutrition: A balanced diet rich in vitamins, minerals, and nutrients is essential for maintaining good health.

- Physical Activity: Regular exercise not only improves physical well-being but also enhances mental health.

- Mental Health: Understanding the impact of mental health on overall well-being is crucial. Stress management and emotional support play significant roles.

By fostering a conscious approach to health, individuals can enrich their quality of life. This affected area can also influence financial stability through medical expenses, emphasizing the necessity of holistic understanding.

Financial Advising: Securing Your Future

In parallel to health awareness, financial advising is an essential pillar of personal development. An effective financial plan helps individuals navigate the complexities of managing their finances, preparing for future needs, and building wealth.

Components of Financial Advising

- Budgeting: Creating a realistic budget is the foundation for effective money management. It helps track income and expenses, ensuring that spending stays within limits.

- Investment Strategies: Understanding the different types of investment vehicles available can greatly enhance financial growth.

- Retirement Planning: Having a well-thought-out retirement strategy allows individuals to enjoy their later years without financial stress.

- Debt Management: Efficiently managing debt is crucial for financial health. Opt for strategies that enable timely payments and minimize interest.

Employing financial advising not only supports personal aspirations but also aids in mitigating health-related financial risks. A good plan prepares individuals not just for today's necessities, but also for unforeseen medical expenses that can arise.

The Role of a Health Coach in Personal Development

A Health Coach serves as a crucial link between understanding one’s health and making informed lifestyle choices. They work with clients to create a personalized plan that aligns with their health goals while also considering their financial situations.

Benefits of Engaging a Health Coach

- Personalized Guidance: Health coaches offer tailored advice based on individual needs, preferences, and circumstances.

- Accountability: Regular check-ins with a coach motivate clients to stay on track with their health goals.

- Holistic Approach: Coaches analyze not just physical health, but also emotional and financial aspects.

- Support and Resources: They provide clients with the tools and resources needed to foster better health choices.

Through a supportive partnership, a health coach helps clients visualize their goals and empowers them to take actionable steps toward achieving a balanced life.

The Interconnection of Health, Finance, and Coaching

The relationship between health and financial security is undeniable. Poor health can lead to increased medical bills, while financial strain can adversely affect health outcomes. Here are several key ways these areas interact:

Health Influencing Financial Decisions

Health issues can result in significant costs, such as hospital bills and lost income due to inability to work. For instance, chronic conditions necessitate ongoing treatment, producing a strain on finances. Consequently, individuals might find themselves needing financial advice to cope with these expenses.

Financial Stress Affecting Health

On the flip side, financial instability often leads to stress and anxiety, which can exacerbate mental and physical health issues. These individuals may neglect their health due to the overwhelming burden of financial turmoil, creating a vicious cycle.

Strategies for Integration: Living Holistically

Integrating health and financial well-being is essential for achieving a fulfilling life. Here are strategies that emphasize holistic living:

1. Establish a Wellness Budget

Just as you would create a budget for your expenses, include a section for health-related costs. Allocate funds for gym memberships, healthy food options, and preventive healthcare measures to ensure your well-being is a priority.

2. Invest in Health Savings Accounts (HSAs)

Utilizing tax-advantaged Health Savings Accounts can mitigate healthcare costs while saving for future medical expenses. This strategy not only enhances financial security but also encourages proactive health management.

3. Seek Professional Help

Engage both health coaches and financial advisors to create a comprehensive lifestyle plan. Their combined expertise can guide you in making informed decisions that benefit both your health and finances.

4. Educate Yourself

Continuously seek knowledge about both health and finance. Understanding the latest health trends and financial tools empowers individuals to make better choices.

Embarking on Your Journey at Green Web Life

The path to holistic well-being begins with informed choices and resources. At greenweblife.com, we provide a wealth of information surrounding Health & Medical topics, Financial Advising, and Health Coaching that can aid you in creating a balanced lifestyle.

Conclusion

In conclusion, prioritizing health and financial security in tandem leads to a thriving life. By integrating these aspects, and leveraging the support of professionals, individuals can attain their goals and enjoy a fulfilling existence. Promote health, achieve financial stability, and work towards becoming the best version of yourself—starting today.

https://greenweblife.com/